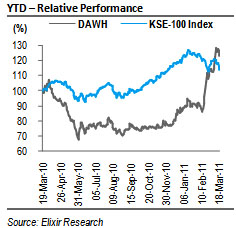

Strong returns post stock dividend excitement: DAWH has rallied 82% since CY10 result announcement, as market welcomed 300% stock dividend announced with full year results. Post share price appreciation, we believe CY10 earnings revival and value of investments are adequately reflected in share price.

Earnings would likely rise by 6% in CY11: We expect CY11 EPS to increase to PKR28.50/share for DAWH, as growth in profit from associate, and higher Urea prices shall offset production loss due to higher gas curtailment. We expect CY11 core EPS at 6.76 (-37% YoY).

Value accretion from Engro Urea plant commencement and subsidiary listings a key upside: Engro Corp’s EPS will likely jump 6% YoY in CY12 due to full year impact of new plant commencement. Listing of Engro Corp’s subsidiaries would improve visibility of investment value. DAWH holds 150mn shares of Engro Corp (adjusted for bonus), equaling 1.25 shares per share of DAWH (pre ex bonus).

Investment perspective – CY10/11E P/E of 10.2x/9.7x: At yesterday’s closing price of PKR275.8/share, the scrip trades at an expensive CY10/11E P/E multiple of 10x/9.7x.

Strong returns post stock dividend excitement

DAWH has rallied 82% since CY10 result announcement, as market welcomed 300% stock dividend announced with full year results. While stock dividend is valuation neutral, it is taken as an indicator of future growth and is generally appreciated by the market. Post share price appreciation, we believe CY10 earnings revival and value of investments are adequately reflected in share price. CY10 earnings for DAWH rebounded to PKR3.3bn (EPS: PKR26.99) as against a loss after tax of PKR1.1bn (LPS: PKR9.46) in CY09.

Earnings would likely rise by 6% in CY11

We expect CY11 EPS to increase to PKR28.50 for DAWH, as growth in profit from associate, and higher Urea prices shall offset production loss due to higher gas curtailment. Incorporating 20% gas curtailment and current Urea prices of PKR1020/bag, we estimate CY11 core EPS at PKR6.8 (-37% YoY), whereas EPS contribution from share of profit from associates shall rise to PKR21.7/share in CY11.

Value accretion from Engro Urea plant commencement and subsidiary listings a key upside

Engro Corp’s EPS will likely jump 6% YoY in CY12 due to full year impact of new plant commencement, as well as higher utilization levels as CY11 shall witnesses staged ramp-up of plant utilization. On the other hand listing of Engro Corp’s subsidiaries would improve visibility of investment value. Engro Corp. plans listing of 3 of its subsidiaries in CY11, including Engro Foods, Engro Fertilizer, and Engro Energy. DAWH holds 150mn shares of Engro Corp, equaling 1.25 shares Engro Corp. per share of DAWH, based on current shares (prior to ex-bonus).

Investment perspective – CY10/11E P/E of 10.2x/9.7x

At yesterday’s closing price of PKR275.8/share, the scrip trades at an expensive CY10/11E P/E multiple of 10.2x/9.7x, and a premium of 7% to its portfolio value.

Economic & Political News

Non-performing loans grow to PKR562bn

The non-performing loans (NPLs) of all banks and development financial institutions (DFIs) increased to PKR562.4bn for the period ended in Dec 2010 against PKR508.83bn by the quarter ended on September 30, 2010, the State Bank of Pakistan (SBP) said on Monday.

Oil prices for April: Ogra expecting 10 to 15% increase

Oil and Gas Regulatory Authority (Ogra) is expecting 10 to 15% increase in oil prices for April 2011 in line with hike in global prices followed by unrest in Middle East and surging demand in Japan for fuel after earthquake.