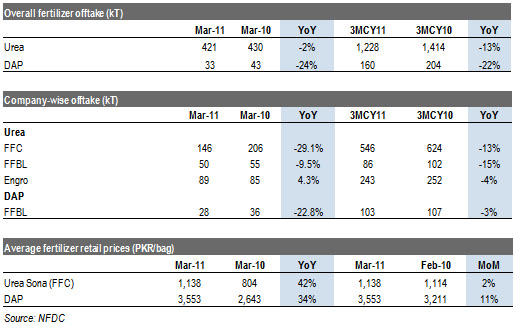

Mar-11 – Last month of Rabi recorded decline in fertilizer offtake: Dispatches of both Urea and DAP remain depressed, falling by 2% YoY and 24% YoY respectively, as Rabi season ended. 1Q cumulative offtake of Urea and DAP plunged 13% YoY and 22% YoY respectively, primarily attributable to lower availability of gas and plant shutdowns on Sui network.

Supply cuts kept prices firm, benefitting manufacturers: More than expected gas curtailment from the sector in a scenario where 1) CY11E local demand likely to comfortably exceed domestic production, 2) local prices at 37% discount to international Urea prices, led manufacturers to increase prices to offset lower volumetric sales. 1QCY11 earnings growth remained robust as a result.

Accumulation for kharif to drive volume growth in the upcoming months: We foresee a strong demand growth of fertilizers in the upcoming months as kharif accumulation picks up. Post flood increase in area under cultivation shall further support fertilizer demand. Given the continuation of gas diversion, we anticipate prices to remain firm and drive earnings growth for fertilizer manufacturers.

Mar-11 – Last month of Rabi recorded decline in fertilizer offtake

During Mar-11, the last month of Rabi season, Urea offtake fell 2% YoY to 421k tons, while DAP registered a much larger – 24% YoY – decline to 33k tons. 1QCY11, cumulative Urea and DAP offtake plunged 13% YoY and 22% YoY to 1,228k tons and 160k tons respectively mainly on the back of lower availability due to gas curtailment and resulting plant shutdown for fertilizer manufacturers on Sui networks. With Kharif sowing season starting from April with Rice and Cotton sowing, we anticipate fertilizer demand to pick up. Urea, being the main

ingredient for soil preparation for Rice and Cotton sowing, shall be the key beneficiary of Kharif demand, while DAP demand shall pick up significantly in 2H when pre-Rabi season accumulation starts.

Supply cuts kept prices firm, benefitting manufacturers

During Mar-11, average Urea prices, though up a mere 2% MoM, were a staggering 42% higher on YoY basis. DAP prices, on the other hand, increased 34% YoY to PKR3,553/bag (up 11% YoY). 1QCY11 average Urea prices rose 37% YoY while DAP prices increased 34% YoY. Higher gas curtailment from fertilizer sector in a scenario where 1) CY11E local demand is likely to comfortably exceed domestic production as we expect a shortfall of 516k tons assuming gas curtailment to continue during the remaining part of the year, and 2) local prices at 37% discount to international Urea prices, led manufacturers to increase prices to offset lower volumetric sales. 1QCY11 earnings growth remained robust as a result. Post removal of sales tax exemption, higher tax incidence was comfortably passed on to the farmer.

Accumulation for kharif to drive volume growth in the upcoming months

We foresee demand uptick in fertilizers in the upcoming months as kharif accumulation picks up and agricultural activity improves post flood devastation. Given the continuation of gas diversion, we anticipate prices to remain firm be the key driver of earnings growth, as it it was in 1QCY11. FFBL and ENGRO, having already announced their results, witnessed earnings growth of a 92% YoY and 13% YoY respectively, while for FFC we estimate earnings to rise 49% YoY for 1Q.

Economic & Political News

Electricity tariff: NEPRA allows Re1 per unit hike

Nepra officials informed that the Central Power Purchasing Agency (CCPA) had requested a PKR1.04 per unit increase in the tariff, citing the fuel price variation for the month of March. However, after examining the request, Nepra has allowed a hike of PKR1 per unit.

Notices for freezing PSO accounts: PSO seeks intervention of Petroleum Ministry

The cash-strapped Pakistan State Oil (PSO) has sought intervention of Ministry of Petroleum and requested to take up issue with Finance Ministry relating to notices issued by tax authorities to freeze its bank accounts due to a default on tax payment.